Ask a MoFo: Comparing Convertible Notes to Safes

The Role of Convertible Instruments

Startups of all sizes and at various stages of their lifecycles need to raise capital. While selling shares may sound the simplest, doing so directly is not always the most efficient or appropriate choice. While seemingly straightforward, raising capital by issuing priced equity requires agreeing to a fixed valuation of the company and, typically, a large variety of terms to govern the stockholders’ relationship with each other and with the company. Sometimes the parties cannot agree (or cannot agree efficiently) on some mix of the valuation and the other terms of the transaction such as other market-based bells and whistles including board seats, liquidation preferences, and down round antidilution protection among others.

One solution is convertible instruments; these are investment contracts that provide the holder a right to convert their investment into equity of the company if and when certain pre-determined events happen, such as a priced equity round (i.e., a Series A financing). Convertible instruments can vary, but the two most common are convertible notes and simple agreements for future equity (“Safes”).

Convertible instruments allow the ultimate valuation of the company’s equity, and much of the expense associated with negotiating shareholder agreements and issuing equity, to be deferred, with investor-protective guardrails, to a later date and time where more data is available and, generally, when more money is being raised by the company. In other words, convertible instruments allow companies to raise money earlier and more efficiently than if priced equity were the only option, while giving investors a potentially advantageous price at the expense of not getting governance or economic control at the time of their initial investment.

What’s the Same: Caps, Discounts, or “Better Of”

Both instruments are non-dilutive unless and until converted into equity. Standard conversion features are: (1) a valuation cap, (2) percentage-based discount, or (3) the “better of” the cap or discount.

Valuation caps set a maximum valuation at which the convertible instrument can convert in an equity financing. There are different formulations of cap (post-money and pre-money, which will be the topic of another article), but in either variation the end result is that, in subsequent financings with valuations well above the cap, the convertible instrument will convert at a significant discount and in subsequent financings with lower valuations, there may be no discount. The lack of a discount in some scenarios is the driving force behind percentage-based discounts.

Percentage-based conversion discounts apply the agreed discount to the price per share in the subsequent equity financing, giving the investor extra shares for each dollar invested. Another way of thinking about it is that these discounts lock in a dollar value premium relative to the investment. For example, a 20% discount gives an investor a $0.25 boost for every dollar invested (for each invested $1.00 / 0.80 = $1.25 effective value). The discount therefore provides a guaranteed premium but, in a really high-value conversion, may not be a fair return for the early risk.

A “better of” approach covers both outcomes by giving the investor a conversion price that is the lower of the price based on their cap and their discount; this guarantees the investor that they’ll be at least $0.25 per dollar better off than a cash investor in the future conversion round (in this example).

Convertible Notes

Convertible notes tend to be more favorable to investors than Safes because convertible notes are forms of actual indebtedness (until converted into equity) whereas Safes are not (most participants in the market take the position that Safes are equity for tax purposes). In a traditional convertible note financing, investors lend money to the company in exchange for the promise of a repayment or conversion either in connection with an equity financing, a sale of the company, an event of default, or maturity. Convertible notes, unlike traditional debt, typically don’t require incremental repayment (although they can allow for such).

Since convertible notes are considered debt, they accrue interest and have priority over equity in the event of the company experiencing a liquidation event. In most circumstances, convertible notes for early-stage companies are unsecured and so will not have first-priority if there is other secured debt.

Unlike Safes, there is no central starting point for the form of the documents. This means that convertible note financings can be significantly slower to get to closing than Safe financings.

Safes

On the other hand, Safes have many of the same features of convertible notes except they (i) do not have a maturity date or concept of events of default, (ii) do not accrue interest, and (iii) are generally not treated as indebtedness. Because they are not debt, they do not have priority over equity in a liquidation scenario and instead are treated like preferred stock with priority over common stock. As there is no maturity date, Safes only convert to equity upon a preferred stock financing, initial public offering, or sale of the Company.

Until their Safes convert into equity, Safe holders have few if any rights (unless Safes are issued with side letters granting the investors special rights). Safes are sometimes called “Safe notes,” which is a misnomer and incorrect, as Safes are not notes, i.e., they are not evidences of debt.

Despite the company-favorable elements of Safes, they remain popular because of their ease of use and because, in the early-stage context in which they are best suited, the downside protection of convertible notes is not typically of much practical benefit.

In Sum

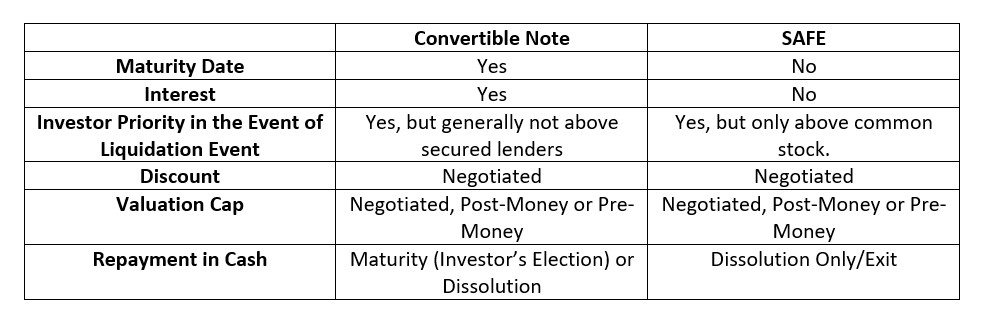

Both Safes and convertible notes are highly customizable documents, so founders should be careful to read them and seek the advice of counsel and other professional advisors. But founders and investors should expect to see the following elements in the most basic forms of Safes and convertible notes:

You can access MoFo’s ScaleUp Templates to see model Convertible Note and Safe agreements.

Receive invites to MoFo startup events and legal updates

ScaleUp

Legal Guidance for Startups