Ask a MoFo: Understanding the Basics of Venture Capital, Growth Equity, and Private Equity

Congratulations, you’ve done it. A technological breakthrough, a new means of leveraging AI for content creation, a new license approved, a new market unlocked—you and your company have finally reached that next inflection point. But how will you capitalize on this moment to take your company to the next level? These exciting milestones are commonly met with the stark reality of a new capital raise. It is important to choose the right investor for your company, at its particular stage, to help you scale up successfully. Which investor makes the most sense for your company’s unique position in terms of business model, life cycle stage, and risk profile? This article highlights a few significant distinctions among notable investor groups.

Traditional venture capital (VC) investors focus on high-risk, high-reward minority investments in early-stage companies, where they can generally aspire to pick the winners in a given industry early, while corporate venture capital investors serve as the investment arms of established companies and seek to align investments with strategic corporate goals.[1] Private equity (PE) investors, on the other hand, typically acquire a controlling position in more mature companies they deem to be ripe for value creation through optimization and to fund continued growth. Growth equity (GE) investors aim to bridge the gap between VC and PE by funding established companies with moderate risk profiles that need capital to scale.

From inception through the maturation of an emerging company, VC, GE, and PE investors each tend to offer distinct advantages (and disadvantages) at different stages throughout a company’s life cycle. When reaching a new inflection point in your entrepreneurial journey, it is prudent to arm yourself with an understanding of the differing investment expectations and incentives of these investor groups.

Venture Capital

VC investors typically have a high risk tolerance and are eager to serve in an advisory role for young disruptive companies. VC funds traditionally target minority investments in early-stage startups, often pre-revenue, aiming for high returns through rapid growth and then an exit via an IPO or sale. The typical VC fund model incentivizes VC investors to make a high number of minority investments in high-risk, high-reward companies (i.e., companies featuring disruptive technologies, aggressive growth strategies, and/or scalable business models), where a few outsized successes offset numerous smaller losses.

Growth Equity

GE investors search for opportunities to deploy capital and add value in ways that can readily scale-up businesses, targeting companies with clear paths to profitability or significant market share increases at an inflection point in their growth trajectory. These targets tend to be more established and proven companies that seek capital to expand (by way of scaling operations, entering new markets, developing new products, etc.), but still only need to raise capital from investors seeking minority, generally passive, positions. GE funds seek returns through a near-term exit, such as an IPO or sale, but target companies with relatively lower risk profiles than VC targets, often investing in later-stage Series C+ and “pre-IPO” rounds, where capital is intended to be the last capital raise necessary to bridge a company through a successful public listing or sale.

Private Equity

PE investors can offer exit opportunities to founders of more mature companies. PE funds typically prioritize value creation through realizing operational efficiencies and strategic market positioning via significant operational and/or financial changes, and they do so by acquiring controlling positions in companies, allowing them to direct management in the manner they view as most valuable. PE investors often employ leveraged buyouts (LBOs), which involve the use of debt financing to fund part of the purchase price of a company acquisition. After acquiring control, PE investors use the acquired company’s assets and cash flows to service and repay the debt used to complete the LBO. PE investors commonly invest in companies with a common focus, such as SaaS or services, to maximize their ability to provide more significant operational efficiencies and synergies to companies in their portfolio.

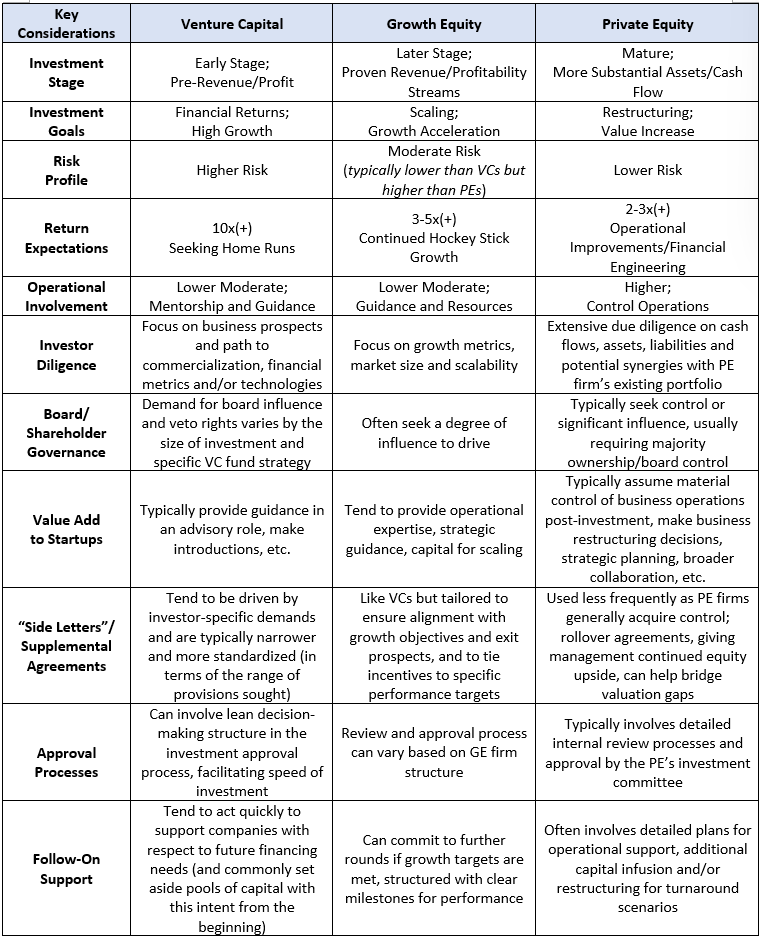

Comparing VC, GE, and PE across certain key criteria can be useful to founders when evaluating proposed investments from across these investor groups. See below for a high-level summary of key considerations to keep in mind as a startup seeking to raise capital.

To be sure, the discussion above is merely a broad brushstroke of a rapidly evolving investor landscape.[2] Moreover, specific investment firms can participate as investors across multiple stages, investing in VC, GE, and/or PE structured transactions. Each investor category offers its own set of expectations, incentives, and strategic benefits that should be considered relative to your company’s needs and goals. The MoFo team is prepared to help you raise capital, ensuring that you have an aligned shareholder base to best position your startup for long-term success.

[1] For more on the distinction between traditional VC and corporate venture capital firms, see Ask a MoFo: An Overview of Traditional Venture Capital vs. Corporate Venture Capital | ScaleUp.

[2] See MoFo Global PE Trends 2024 and Outlook for 2025 | Morrison Foerster.

Receive invites to MoFo startup events and legal updates

ScaleUp

Legal Guidance for Startups