Getting Your AI Startup Ready to Fundraise

Artificial intelligence (AI) startups are at the forefront of technological innovation, attracting investor interest worldwide. However, securing funding is not solely a matter of having cutting-edge technology. Institutional, experienced investors seek to invest in startups that are properly organized, strategically positioned, and well prepared to scale rapidly.

This article will serve as a useful reference guide for any AI entrepreneurs interested in positioning their startups to successfully raise venture capital, minimizing potential legal roadblocks and pitfalls that some encounter, from incorporating your company, assembling your team, protecting intellectual property (IP), and pitching to investors.

IncorporationSelecting the appropriate legal structure is one of the first steps to take, from a legal standpoint, in forming an AI startup. Most startups operate at a loss in their early stages, making it important to choose a structure that maximizes fundraising prospects, provides limited liability protection for shareholders and avoids unnecessary legal and tax expenses. Considering those factors, forming a corporation in Delaware is the most popular choice for fast-growing startups looking to raise venture capital and motivate employees (for an explanation of why that is, see our article).

Other Key Considerations

- Making Progress Before Going Full-Time: Many founders start their businesses while still employed elsewhere, balancing their business ventures with their day jobs. This is a common approach to launching a new business that warrants careful planning. It is almost always preferable to work on your AI startup on your own time, using your own devices and resources. Doing this properly can reduce the risk that your current employer may have a strong claim over portions of your business or IP.

- Incorporate Before Key Milestones:Entrepreneurs should form companies before taking significant actions, like raising money, hiring employees, entering into material contracts, or launching a product. Otherwise, they expose themselves to unnecessary legal risks and, potentially, tax complications.

- Establish a Corporate Infrastructure:Beyond incorporating, additional steps are required to properly organize the company and comply with best practices to establish a strong legal foundation. This generally includes, among other things, appointing directors and officers, issuing stock to founders and early employees, formally assigning IP rights to the company, and setting up an equity incentive plan to attract and retain talent.

- Engage Legal Counsel Early: While online incorporation services can help with basic setup if you know what inputs to use and do not need guidance on how to divide equity and responsibilities among the founders (including to mitigate potential disputes), structure your board and management in line with industry best practices, among other things, it’s advisable to consult with legal counsel experienced in working with startups before signing material agreements or taking other significant actions, such as bringing on key employees, receiving money from investors, or entering into partnership or other commercial arrangements.

Cleaning up legal mistakes made early on can be costly and time-consuming down the road, especially when trying to raise venture capital as quickly and seamlessly as possible. This is why it is advisable to incorporate and organize your company in the right way from the outset.

Hiring an All-Star AI TeamInvestors do not just invest in ideas or products; they invest in teams at companies. A strong founding team, demonstrating the ability to execute, scale, and commercialize AI solutions, makes startups more attractive to investors.

Assignment of IP

Employees and any other service providers working on technical matters should assign relevant IP to the company. Many investors will expect to see all service providers, even those in non-technical roles, to have signed the same agreements as the core IP contributors. In the United States, by default, IP rights typically belong to the individual inventor who creates them, not the company they work for, even when building technology for the business. That is why management should ensure that pre-incorporation IP and any IP created by employees during their tenure with the company is formally assigned to the startup.

Appointing Individuals to Key Leadership Roles

- Board of Directors: The board of directors is the governing body that oversees company strategy and planning. Directors owe fiduciary duties (see more) to the company and its stockholders. In most early-stage startups, founders maintain control over key board decisions, holding a majority of board seats.

- Officers: Officers manage the company’s day-to-day activities and operations. Delaware law requires at least two officers, often titled CEO, President, Treasurer, or Secretary, but companies can use more unique titles such as “Technoking” or “Chief Happiness Officer.”

Structuring Founder and Employee Equity

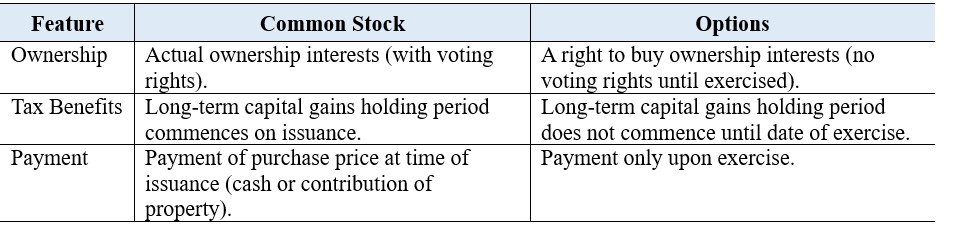

When granting equity to your founding team and employees, companies generally decide between the issuance of common stock or stock options. Founders typically receive common stock while employees receive options, distinguishable in the following key ways:

Both types of equity typically vest over time to ensure the recipient’s continued commitment to the company. A standard vesting schedule is four years with a one-year cliff, meaning recipients must stay for at least one year to retain the first 25% of their equity allocation, with the remaining equity vesting monthly over the following three years.

Tax Considerations for Founders

From a tax perspective, it is advisable to issue common stock to founders as close to the time of incorporation as possible, when the company’s equity is generally worth very little (e.g., pennies per share), before the company’s value meaningfully appreciates.

In addition, founders who receive common stock subject to vesting should make an 83(b) election to optimize the tax treatment of the stock, keeping in mind that the IRS has a strict 30-day filing window from the date of issuance (see more). This applies to stock acquired subject to vesting but not options acquired subject to vesting.

Developing and Protecting IPAI startups rely heavily on proprietary data, models, and algorithms. Thoughtful investors will generally scrutinize a company’s ability to protect and leverage these IP assets before making an investment.

Legal Tools to Protect IP

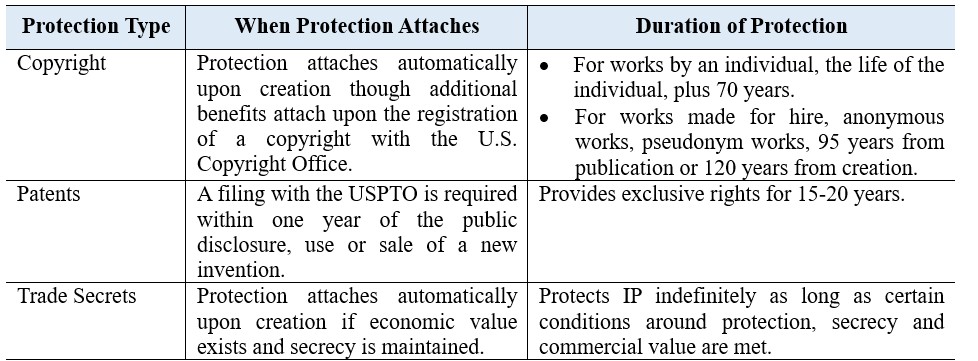

- Copyright: Generally, copyright protection applies to original works of authorship that are fixed in a tangible medium. Copyright protection can apply to source-code and AI-generated content such as visual art, images, music, or text if such work is principally produced by human authorship, with technology merely providing assistance. Recent legal cases have demonstrated that wholly AI-generated images may not be copyrightable, but the selection and coordination of such images by a human could be. Developers must be aware that copyright protection for AI-assisted code may depend on the extent of human involvement in the creation and refinement of the code, emphasizing the need for human oversight to preserve copyright eligibility.

- Patents: Patent protection applies to new, useful, and non-obvious inventions rather than abstract ideas. Unique machine learning models, training processes, data processing methods and specific applications of AI technology—including AI-generated outputs—may be patent-eligible. To increase the odds of patentability, startups should describe how their AI technology provides a novel and practical solution with technological advantages (see more).This principle is particularly important for software development tools like GitHub Copilot, where AI assists in generating code.

- Trade Secrets: Trade secret protection attaches to information that is not generally known to the public, which information provides economic value to those who are in the know due to its secrecy and is subject to reasonable efforts to maintain confidentiality. In the AI space, trade secret protection can apply to wholly AI-generated technology or works that may not be eligible for copyright or patent protection. To avoid loss of trade secret protection, it is advisable to implement access and administrative controls, encrypt proprietary data, and require non-disclosure agreements (NDAs) for employees and partners to prevent unauthorized disclosures.

- Licensing Agreements: When collaborating with partners, suppliers, or customers, particularly when using external models or software tools, AI startups should establish a consistent practice of implementing clear and well-defined licensing agreements. These agreements should be designed to safeguard confidentiality and limit third-party rights over products, source code, or other proprietary information. This approach ensures both legal and financial certainty regarding the use of proprietary AI technology, while also providing protection against potential strategic acquisitions of clients or partners by competitors. Contracts should explicitly outline IP ownership, permissible uses and confidentiality obligations. Furthermore, startups should negotiate for clear usage and ownership rights over AI-generated outputs and limit liability to help mitigate the risk of future disputes.

AI startups should proactively mitigate legal risks to avoid potential litigation and compliance issues. Here are some examples of common mistakes we see early-stage startups making that you should avoid:

- Register or Apply for IP Rights in a Timely Fashion: Delayed IP registration can lead to ownership disputes, loss of rights, and increased vulnerability to infringement. AI startups should ensure that patents, trademarks, and copyrights are filed early to establish and protect their innovations. See below for a timeline-oriented summary of legal protections available:

- Take Caution When Building on Third-Party or Open-Source Software: Outside software may impose additional restrictions that could disrupt the ability to commercialize your product. Certain open-source licenses, such as the General Public License (GPL), impose a commitment to release derivative works under the same license. External proprietary software may also include flowdown restrictions from its own third-party providers. Be aware of open-source commitments or other “dealbreaker” restrictions when deciding to incorporate outside code into your product.

- Avoid Using Third-Party Data Without Proper Permissions: Whether you are using data available from the internet or leveraging data obtained from your own customers, ensure that any third-party data used for training AI models is obtained legally and with proper licensing. Using third-party data without proper permission can result in legal claims, including significant penalties associated with privacy violations, copyright infringement, and contract breaches. Be sure to review and follow terms of service applying to the data.

- Implement Compliance Strategies: AI applications in highly regulated industries must comply with legal standards, such as data privacy laws and anti-discrimination regulations. Failure to implement necessary safeguards can result in fines, litigation, and reputational damage. Use caution when using AI to make critical decisions that significantly impact a person’s welfare, as those fields are typically highly regulated (e.g., health coverage decisions, hiring/firing, loan determinations).

- Look out for Antitrust Issues: AI-driven dynamic pricing must be carefully monitored to ensure it does not violate antitrust laws.

- Beware of Industry or State-Level Requirements Around AI Use: Stay ahead of the evolving state-level regulatory landscape. Multiple states have already passed significant legislation that impose disclosure and use requirements around AI services and outputs.

Consult with a lawyer to find out how to effective use these legal tools to your benefit when seeking capital, rather than defending against questions from an investor’s legal counsel seeking to confirm whether the company complies with applicable legal requirements.

Fundraising ApproachNow that your AI startup is well organized, your all-star team is engaged, and your IP is protected, it’s time to approach investors.

Key Fundraising Tips

- Research Likely Investors: Be deliberate and thoughtful in seeking to meet with investors that specialize in your startup’s core competency—scattershot outreach to investors not focused on your specific area rarely work.

- Find Mutual Connections: Cold email outreach is generally unproductive; identify mutual connections with, or make connections with people that are similar to, your target investors.

- Raise Money from Accredited Investors: Whether you choose to raise capital through the issuance of convertible instruments or through a priced equity round (see more here), you should generally ensure that all investors are “accredited investors” under federal securities laws. When doing (reverse) diligence on your prospective investors, make sure to send them a questionnaire to confirm that they fulfill one or more of the accredited investor criteria.

Final Thoughts: Setting Up Your AI Startup for Success

Raising capital for an AI startup is a multi-step process requiring—in addition to valuable technology—legal foresight, strategic planning, and investor alignment. By establishing the right company structure, protecting your IP, assembling a strong team, and avoiding common legal pitfalls, you can increase the likelihood of securing funding quickly and scaling ahead of any competitors.

This article is based on a webinar available in recorded video format.

Receive invites to MoFo startup events and legal updates

ScaleUp

Legal Guidance for Startups